In the summer of 2016, British Columbia’s Liberal government led by Christie Clark was facing enormous pressure from the general public to provide solutions to the real estate crisis that had been steadily deteriorating rental vacancy rates and creating general unaffordability for young middle class Vancouverites aiming to enter the real estate market. Initially resisting calls to implement forms of policy solutions, commissioning studies found that foreign investment had drastic effects on our housing market. [su_tooltip style=”bootstrap” position=”east” title=”footnote #1″ content=”A billion dollars of property was purchased by foreign buyers in 5 weeks in the summer of 2016 (Vancouver Sun, 2018).”][1][/su_tooltip] Quickly doing an about-face on the issue, the Liberals announced a Housing Affordability Package that enclosed a foreign buyers tax of 15%.

Building on the momentum of popular opinion of this crisis, following a narrow election win in 2017, the BC NDP minority government quickly moved to institute new tax rules. Amongst their election platform was a speculation and empty homes tax that affected much of British Columbia’s hottest real estate markets. [su_tooltip style=”bootstrap” position=”east” title=”footnote #2″ content=”(Government of british columbia, 2018)”][2][/su_tooltip]

Has the tax helped? While luxury homes and properties worth a million-plus did drop, there is strong evidence that for the most affordable segment of the market (condominiums) has risen in price. Experts now predict that the record-breaking prices of two years ago may return. [su_tooltip style=”bootstrap” position=”east” title=”footnote #3″ content=”(Connolly, Metro Vancouver home prices could return to peak levels in a year: CMHC, 2019)”][3][/su_tooltip] The only benefit it seems is that the provincial government is facing a windfall in tax revenue: $115 million dollars in 2018-2019. [su_tooltip style=”bootstrap” position=”east” title=”footnote #4″ content=”$58 million in 2018, and $57 million in 2019. Estimates for tax revenue attributed to the tax are $185 million for the next two years (Woo, 2019).”][4][/su_tooltip]

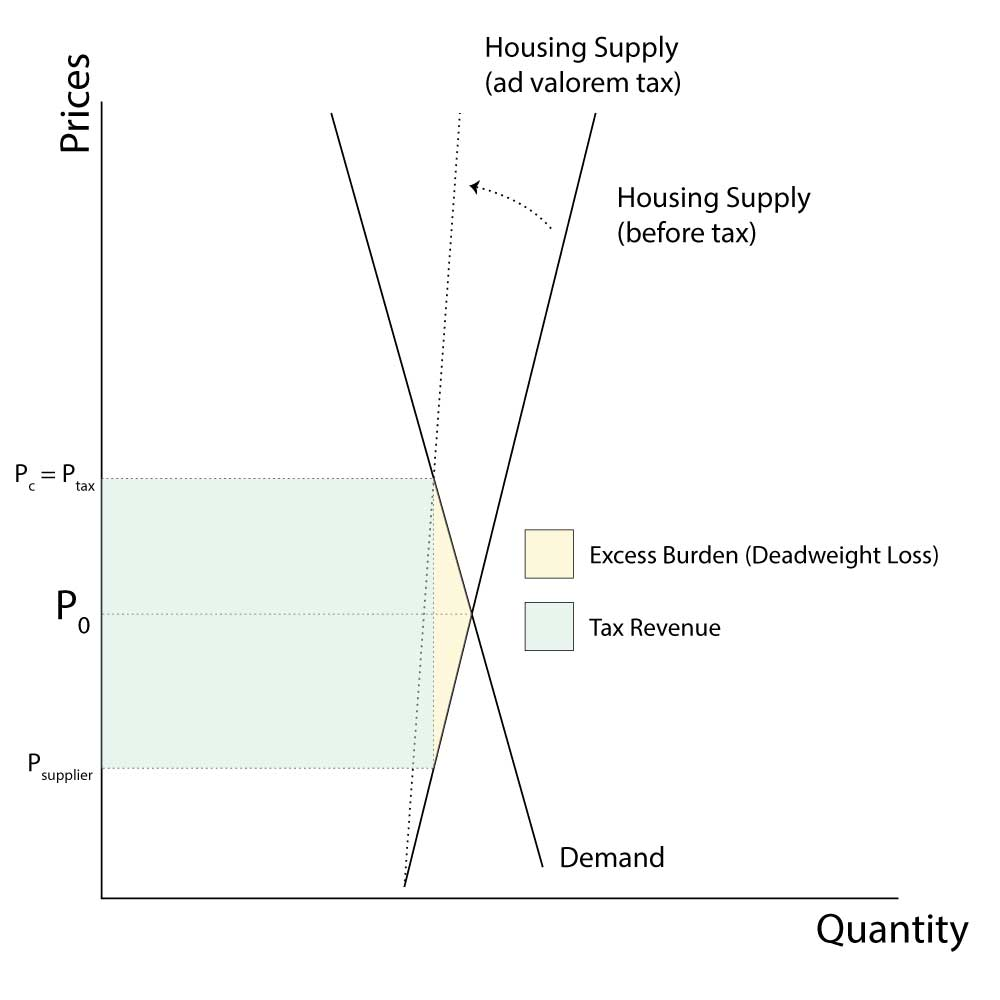

Supply side. Looking at the constraints of our region, it’s evident that lack of land is one big reason why prices are relatively high: mountains prevent us from expanding supply north and the waters of the Pacific Ocean limits us westward. The high livability metrics of our cities drives a lot of demand to the market. With housing stock being so constrained physically as well as needing ample time for developers to increase it, we can assume that the supply of housing is extremely inelastic, at least in the short term. The ad-valorem nature of the vacancy and speculation tax essentially steepens an already quite steep curve, making it even more inelastic.

Demand side. Housing has a very high degree of necessity meaning that we will continue to demand similar levels regardless of price variations. Coupled with the fact that there aren’t really any substitutes for reasonable low-cost dwellings, especially with the lack of supply of alternative solutions, and strict zoning laws that inhibit supply’s growth in the province, demand is strongly inelastic as well.

Economic theory tells us that in a situation of relatively low elasticity for both supply and demand, it is quite clear that there will be a rather large tax revenue extracted from both consumer and producer surplus. [su_tooltip style=”bootstrap” position=”east” title=”footnote #5″ content=”The curve that is more inelastic will have more surplus extracted from it. So, if the supply was more elastic, producer surplus would be a smaller part of the tax revenue the government collects.”][5][/su_tooltip] The excess burden of the tax on the market is minimized due to the inelastic measures.

In a complex market such as real estate, where both suppliers and consumers face numerous constraints and incentives, it’s often difficult to predict the totality of an effect a tax will have on price. But with $57 million raised in 2019 and the average taxed property being worth $1.45 million (Meissner, 2019), this was anything but an attempt to control affordability in our province. [su_tooltip style=”bootstrap” position=”east” size=”default” title=”footnote #6″ content=”The speculation and vacancy tax did not target lower-priced properties that would help entry-level buyers.”][6][/su_tooltip] It was simply a shrewd and opportunistic implementation of a tax to fill government coffers without creating too much inefficiency in the market overall. British Columbians can only hope that with this added windfall, the government will be in a better position to spend this revenue on boosting affordable supply.

[su_accordion][su_spoiler title=”References” open=”no” style=”fancy” icon=”plus-square-2″ anchor=”” class=””]B.C. NDP. (2017). Making things more affordalbe for your family. Retrieved from Our commitments: https://www.bcndp.ca/affordability

Bell, L. (2019, August 12). The impact of british columbia’s real estate taxes on the mobile employee. Retrieved October 29, 2019, from Chartered professional accountants of british columbia: https://www.bccpa.ca/industry-update/news/2019/august-en/the-impact-of-british-columbia-s-real-estate-taxes-on-the-mobile-employee/

Connolly, J. (2018, November 28). The big squeeze: vancouver rental vacancy rate tightens again. Retrieved October 29, 2019, from Vancouver courier: https://www.vancourier.com/real-estate/the-big-squeeze-vancouver-rental-vacancy-rate-tightens-again-1.23512351

Connolly, J. (2019, October 25). Metro Vancouver home prices could return to peak levels in a year: CMHC. Retrieved October 28, 2019, from Vancouver courier: https://www.vancourier.com/real-estate/metro-vancouver-home-prices-could-return-to-peak-levels-in-a-year-cmhc-1.23988230

Government of british columbia. (2018). Frequently asked questions about speculation and vacancy tax. Retrieved October 30, 2019, from Speculation & vacancy tax: https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax/faq-speculation-and-vacancy-tax

Meissner, D. (2019, September 12). B.C. speculation and vacancy tax helps ease housing crunch: finance minister. Retrieved October 29, 2019, from The national post: https://nationalpost.com/pmn/news-pmn/canada-news-pmn/b-c-raked-in-115-million-in-vacancy-tax-from-about-12000-homeowners

Vancouver Sun. (2018, February 28). New tax on foreign buyers of metro vancouver real estate. Retrieved October 31, 2019, from Youtube: https://youtu.be/Sm7rT3jy1vI

Woo, A. (2019, September 12). B.C. tax on real estate speculation and empty properties brings in $58-million for 2018. Retrieved October 30, 2019, from The globe & mail: https://www.theglobeandmail.com/canada/british-columbia/article-bc-speculation-and-vacancy-tax-brings-in-58-million-for-2018/

[/su_spoiler][/su_accordion]